On March 10th, 2023, Silicon Valley Bank (SVB) failed due to a massive bank run, marking it as the second-largest bank failure in US history.

Many believed the crisis came unexpectedly, but the red flags were there, and some economists and financiers accurately predicted it. To better understand why this happened, it’s essential to consider two simple but critical concepts about money or capital; risk and return. Return is simply how much you can increase your principal in a given time, while risk is the likelihood of losing your capital.

Both risk and return must be taken into account, and you cannot consider one without the other. In any thing you do with your money, you must minimize the risk, and maximize the returns. When you deposit your savings in a bank, you assume that (1) it is the safest place to keep your cash, and (2) it will pay you interest, generating income, albeit a small amount.

Like every other industry, banks compete immensely for your deposit often by paying higher interest rates. Naturally, you would deposit your money in the safest bank that pays the highest interest. However, unlike other industries, banks not only compete with each other but also compete with the government in attracting your money. Instead of banks, you can loan your money to the government for a specific period with a particular interest rate by buying US treasuries, the safest assets.

The interest on the Treasuries may be above, equal, or below what you would get from a bank. When the interest rate that the Treasuries pay is considerably higher than what you would typically get from banks, it is natural to park your money with the government instead of the banks. This has been occurring over the past year.

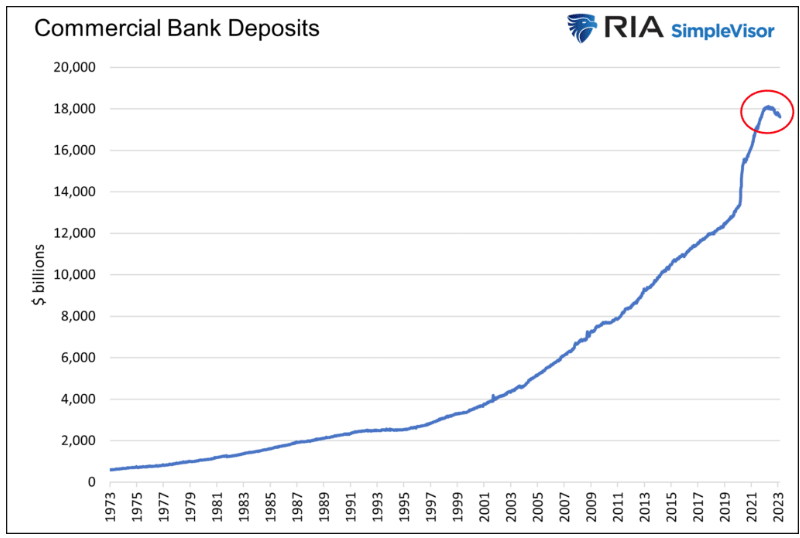

The average US bank account savings rate is only 0.37%, according to government data, compared to the Fed’s benchmark rate of 4.75%. Practically, this means you can earn much more by purchasing the Treasuries than having your money with a bank. As a result, deposits have been exiting the banks, which is visible in the figure below.

For the first time since World War II, deposits have been leaving banks at an extreme rate. This is not limited to small to mid-sized banks like SVB; the same trend is occurring in big banks. The reason behind this shift is due to the fact that US treasuries offer a lower risk compared to banks (since it is more likely for a bank to fail than for the federal government to default on its debt) and a higher return. As a result, money is naturally flowing away from banks and towards US treasuries.

Now that we learned about this ongoing deposit flight, let’s take a look at the other side of the story.

In an effort to bring down the inflation rate, The Federal Reserve made the decision to sharply increase the Fed Funds rate over a year ago in March 2022. As a result, the interest rates on short-term treasury bills increased significantly.

This is all while banks had been hoarding long-term treasuries with very low interest rates, as a consequence of the Fed keeping the rates artificially low for nearly 15 years. I say “as the consequence” because that was the best banks could do with their cash since the treasuries were deemed to be the least risky assets out there.

As a result, banks are now sitting on huge unrealized losses on their balance sheets. Unrealized means the losses are on paper. If they are forced to sell these assets for any reason, then the losses become realized.

In the fractional banking system, banks loan out more than they keep in cash reserves. Therefore, any indication that a bank is in trouble and may not have enough cash reserves to meet deposit outflows can result in a bank run. And of course, bank runs can occur a lot faster in the era of online banking compared to the 1930s.

And this is what happened to SVB which in addition to the ongoing deposit flight, had the highest unrealized loss over total equity among all banks. They were forced to sell some of their treasury holdings “at a loss” to cover their obligations which signaled the market that they were in trouble. After all, if they could raise cash some other way, why would they have to sell their holdings at a loss?

Because of the potential catastrophic impact of bank failures, the government intervened by creating a new facility called BTFP to inject liquidity into troubled banks and ease market concerns. Through BTFP, banks experiencing deposit outflows can borrow money from the Fed instead of selling bond holdings at a loss. There is ongoing debate about whether the Fed’s actions were appropriate or not, but that is a separate discussion.

The 2023 “financial crisis” has begun and as the famed economist Peter Schiff has said; “SVB is just the tip of the iceberg”. The recent government program, BTFP, aimed at injecting liquidity into troubled banks, has only delayed the inevitable crash. Despite the success of the Fed in containing the initial chaos caused by SVB and other banks, the underlying issue of deposit flight and unrealized losses in banks remains unaddressed. The program only served to alert the public to the risks and missed returns on deposits in banks.

Leave a Reply